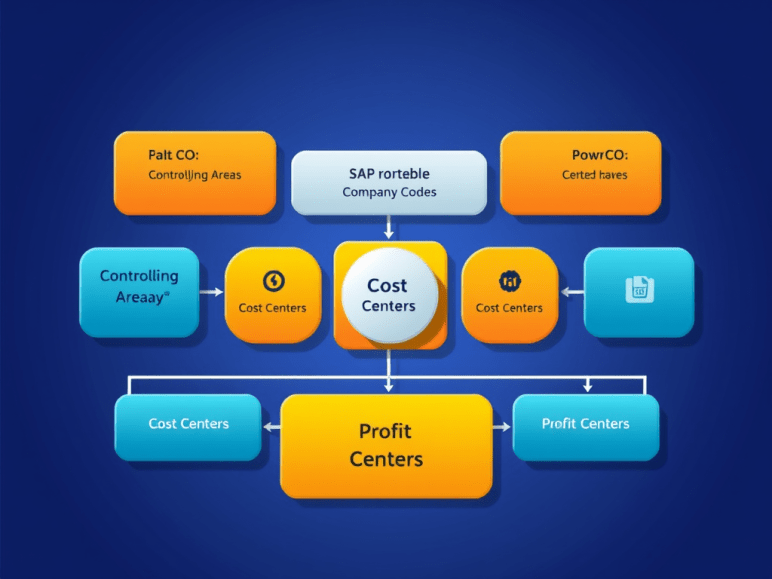

The organizational structure in SAP Controlling (CO) defines how costs and revenues flow through your enterprise. Understanding this structure is essential for proper cost allocation, reporting, and analysis. Below is a breakdown of the key organizational units in SAP CO and how they interact.

1. Controlling Area (CO Area)

- What? The highest-level organizational unit in SAP CO.

- Purpose: Represents a self-contained cost accounting environment.

- Key Features:

- Can include one or more company codes (but a company code can only belong to one CO area).

- Used for cross-company cost accounting.

- Defines fiscal year, currency, and cost center hierarchy.

- Example:

- A multinational company may have different CO areas for different regions (e.g., “CO_US” for the USA, “CO_EU” for Europe).

2. Company Code (FI)

- What? The smallest legal entity in SAP FI (Financial Accounting).

- Relation to CO:

- Multiple company codes can be assigned to a single Controlling Area.

- Financial transactions (FI) are recorded at the company code level, while management accounting (CO) operates at the Controlling Area level.

- Example:

- “CC_US” (Company Code USA) and “CC_UK” (Company Code UK) can both be assigned to “CO_GLOBAL.”

3. Cost Centers

- What? Departments or functional areas where costs are incurred.

- Structure:

- Belongs to a Controlling Area.

- Can be grouped in a Cost Center Hierarchy (e.g., “Production” → “Manufacturing” → “Assembly Line”).

- Use Case:

- Tracks expenses for HR, IT, Marketing, etc.

4. Profit Centers

- What? Business units evaluated for profitability (e.g., product lines, regions).

- Structure:

- Assigned to a Controlling Area.

- Can be structured in a Profit Center Hierarchy.

- Use Case:

- Compares profitability between “North America Sales” vs. “Europe Sales.”

5. Functional Areas (Optional)

- What? Classifies costs based on business functions (e.g., Production, Sales, Admin).

- Relation to Cost Centers:

- A cost center can be assigned to a functional area.

- Use Case:

- Helps in P&L reporting by functional area.

6. Business Area (FI-CO Integration)

- What? Used for segment reporting (e.g., Divisions, Product Lines).

- Relation to CO:

- Business Areas can be linked to Profit Centers for consolidated reporting.

- Example:

- “BA_Automotive” vs. “BA_Finance” divisions.

7. Operating Concern (CO-PA)

- What? The highest unit in Profitability Analysis (CO-PA).

- Purpose: Defines the structure for market segment reporting.

- Components:

- Characteristics (e.g., Customer, Product, Region).

- Value Fields (e.g., Revenue, Cost of Goods Sold).

- Example:

- “OP_CONCERN_Global” analyzes profitability by region, product, and sales channel.

How SAP CO Org Units Work Together

| FI Structure | CO Structure | Integration |

|---|---|---|

| Company Code | Controlling Area | Multiple company codes can be assigned to one CO Area. |

| Business Area | Profit Center | Used for cross-functional profitability analysis. |

| General Ledger (FI) | Cost Element (CO) | Primary cost elements are linked to GL accounts. |

Key Configuration Steps in SAP CO Org Structure

- Define Controlling Area (SPRO: Controlling → General Controlling → Organization → Maintain Controlling Area).

- Assign Company Codes to the Controlling Area.

- Set Up Cost Center Hierarchy.

- Define Profit Centers and assign them to the Controlling Area.

- Configure Operating Concern for CO-PA.

Conclusion

The SAP CO organizational structure ensures proper cost allocation, profitability tracking, and management reporting. Key components include:

✔ Controlling Area (Master CO unit)

✔ Cost Centers (Track departmental costs)

✔ Profit Centers (Evaluate segment profitability)

✔ Operating Concern (For CO-PA market analysis)