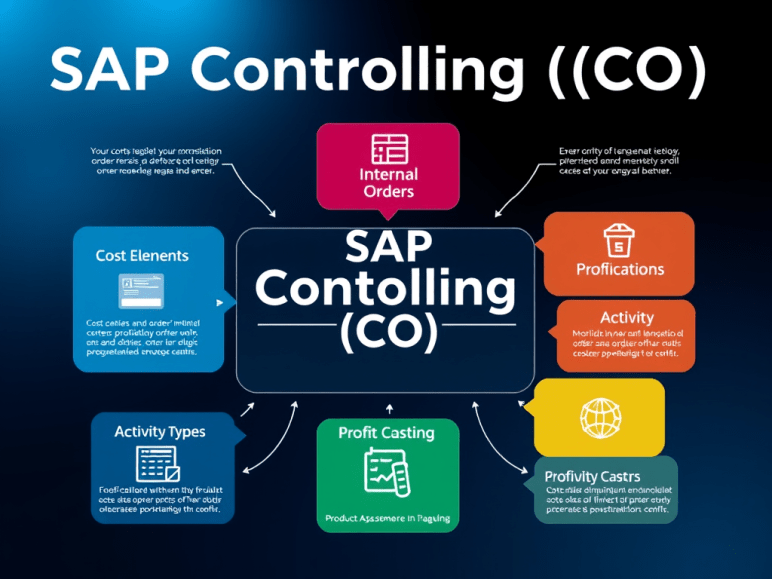

SAP Controlling (CO) is a core module in SAP ERP that helps businesses track, analyze, and optimize costs for better financial decision-making. Below are the fundamental concepts of SAP CO that every beginner should know.

1. Cost Elements

- What? Cost Elements classify different types of costs (e.g., salaries, rent, raw materials).

- Types:

- Primary Cost Elements (linked to FI-GL accounts) – e.g., Electricity Expense (GL Account).

- Secondary Cost Elements (internal allocations) – e.g., Overhead costs distributed to departments.

- Use: Helps in tracking where money is spent.

2. Cost Centers

- What? Departments or functional areas where costs are incurred (e.g., HR, IT, Marketing).

- Purpose:

- Monitor expenses by department.

- Allocate costs for internal reporting.

- Example:

- Cost Center “HR_DEPT” tracks all HR-related expenses.

3. Internal Orders

- What? Temporary cost collectors for projects, events, or campaigns.

- Types:

- Overhead Orders (e.g., Company party expenses).

- Investment Orders (e.g., Machine purchase tracking).

- Use: Helps track short-term costs separately from regular departments.

4. Profit Centers

- What? Business units evaluated for profitability (e.g., Product lines, Regions).

- Purpose:

- Compare profitability across different segments.

- Used for management accounting (not legal reporting).

- Example:

- Profit Center “US_Sales” tracks revenue & costs in the US market.

5. Activity Types

- What? Represents internal activities (e.g., Machine hours, Labor hours).

- Purpose:

- Allocate costs based on internal activities.

- Used in Activity-Based Costing (ABC).

- Example:

- “LABOR_HRS” – Cost of employee hours assigned to production.

6. Product Costing

- What? Calculates the cost of manufacturing a product.

- Components:

- Material Costs (raw materials).

- Labor Costs (production hours).

- Overhead Costs (indirect expenses).

- Use: Helps in pricing decisions and cost reduction.

7. Profitability Analysis (CO-PA)

- What? Analyzes revenue and profit by market segments.

- Dimensions:

- Customer, Product, Region, Sales Channel.

- Use: Helps in strategic decisions (e.g., Which product is most profitable?).

8. Settlement & Allocation

- What? Process of distributing costs from one object to another.

- Methods:

- Direct Allocation (Cost Center → Cost Center).

- Assessment (Overhead costs distributed based on a key).

- Reposting (Moving costs from one object to another).

Conclusion

These basic SAP CO concepts form the foundation for cost accounting and management reporting. Understanding them is crucial for:

✔ Controlling expenses

✔ Improving profitability

✔ Making data-driven business decisions